The American Dream Press Release

FOR IMMEDIATE RELEASE

INTRODUCING A NEW LIFESTYLE AND REAL ESTATE TV SHOW

Featuring the most influential voices in real estate

Sheri Dettman - Lifestyle Realtor/TV Host

Featuring

Palm Springs, La Quinta, Palm Desert, Rancho Mirage, Indian Wells, Indio, Cathedral City, and Thermal

The American Dream TV proudly announces the release of its newest show set to captivate audiences nationwide. The Emmy-nominated TV show, celebrated for its compelling blend of lifestyle and real estate narratives, airs on national platforms such as The Travel Channel and prominent streaming services including Amazon Prime, YouTube Movies & TV, Tubi, Amazon Fire, Apple TV, and Roku. With a substantial social media presence and commanding visibility on leading streaming platforms, The American Dream TV solidifies its expansive reach and profound influence.

The American Dream TV, together with its production team, has garnered acclaim including an Emmy nomination, Telly Awards, and Viddy Awards, along with national recognition for showcasing authentic stories of neighborhoods and featuring top real estate professionals. Each episode spotlights elite realtors and mortgage lenders chosen for their expertise, reputation, and recognition from both peers and clients.

Executive show producer Craig Sewing, Inman News Nominee for "Most Influential in Real Estate," carefully selects the best hosts to represent the voice of lifestyle and real estate in each market. The show can be watched on a variety of networks and boasts millions of views on social media, proudly embracing its identity as “positive media” specializing in real estate, lifestyle, and culture.

About The American Dream TV:

American Dream Media and Tech is a dynamic media company delivering premium content and innovative technology solutions. The American Dream TV, an Emmy-nominated national TV show centered around real estate and lifestyle, inspires and enriches communities across the country through positive media. Featuring over 1,000 top-producing real estate professionals as the authentic voice of their markets, the show airs on major networks and streaming platforms, amassing millions of views.

Connect with us: americandreamnetwork.tv

On social: @theamericandreamtv

As Seen On

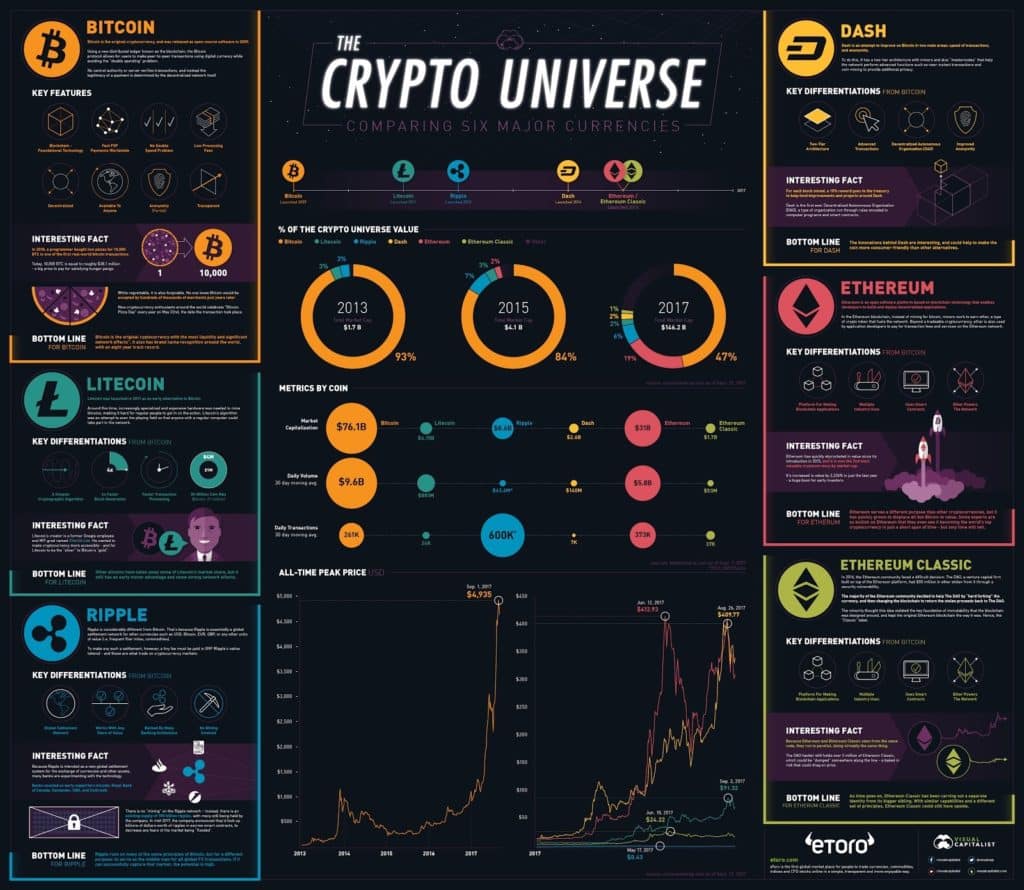

“I’ll sell my house for bitcoin” is the latest marketing tactic, and it’s working … at least for publicity.”

“I’ll sell my house for bitcoin” is the latest marketing tactic, and it’s working … at least for publicity.”