Live with Kelly and Mark – Love Palm Springs

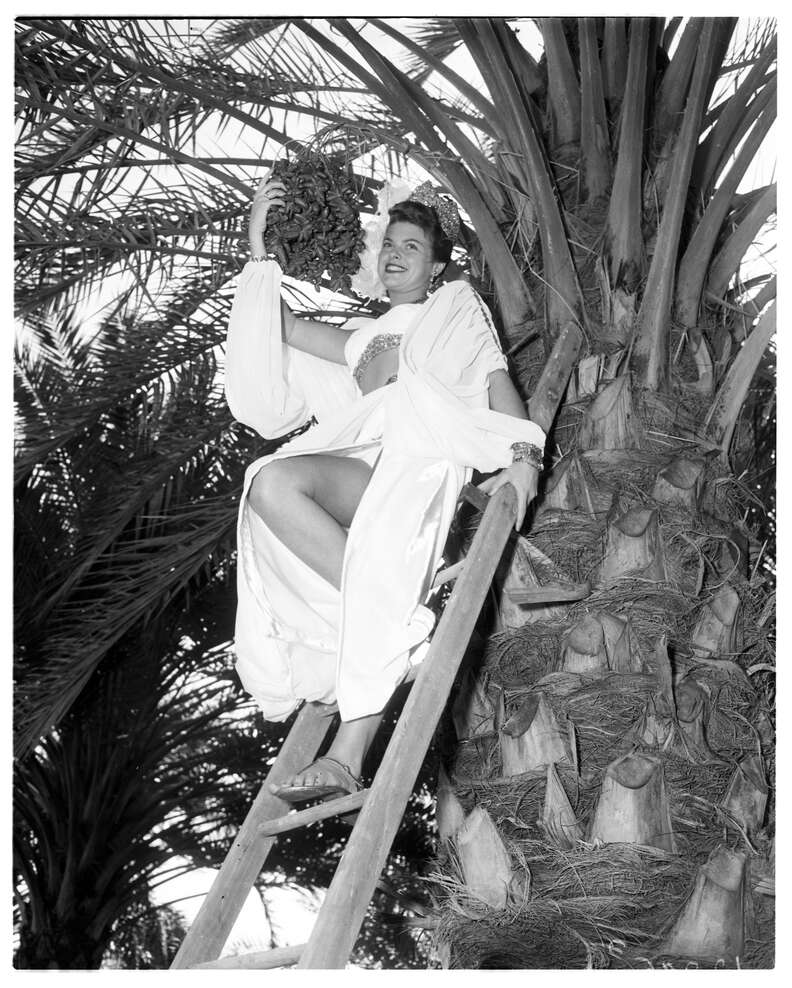

On today's episode, Kelly and Mark talk about their love of Palm Springs, their visit last week, the friendliness of the people, the sunshine, the citrus, the restaurants, and everything they love about the Coachella Valley!